Table of Contents

ToggleWhy File Online Tax Return in Bangladesh?

Updated 20th Aug 2025

When it became mandatory for individual taxpayers in certain areas to file their income tax return online last year in 2024, there was a huge response.

More than 1.7 million taxpayers filed their income tax return online. This included all officials and employees working in banks across the country and some multinational companies.

People can pay their taxes from home using a bank transfer, debit card, credit card, bKash, Rocket, Nagad, or any other mobile financial services app.

They can also file their income tax retun online. If you have any trouble completing your income tax returns online, the National Board of Revenue has dedicated staff who will be available 24/7 through the call center and other electronic means to help you fix the situation right away.

Who will File Online Tax Return in Bangladesh?

Filing of online income tax return in Bangladesh has been made compulsory for all individual taxpayers in Bangladesh. Through a special regulatory order passed by the National Board of Revenue, the online filing of income tax returns in Bangladesh has been made mandatory for all individual taxpayers across the country. However there are certain categories who can with due application still file taxes offline.They are

- Senior taxpayers aged 65 (sixty-five) years or older.

- Physically challenged taxpayers or taxpayers with special needs.

- Bangladeshi taxpayers residing abroad.

- The legal representative or legal heirs or successors of a deceased taxpayer.

When to File Online Tax Return in Bangladesh for individuals?

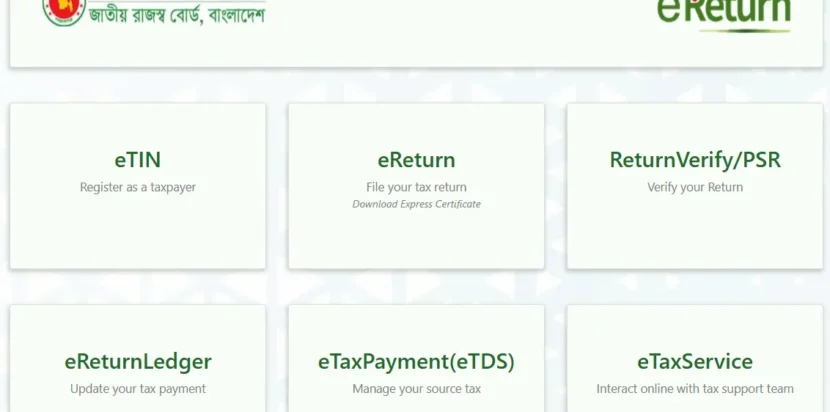

From the upcoming 4th of August, 2025, all individual taxpayers will be able to file their income tax returns for the 2025-2026 tax year online (www.etaxnbr.gov.bd).

Exception to File Online Tax Return in Bangladesh Other Than Categories Mentioned Above

If other individual taxpayers can’t file their income tax returns online because of problems with registering for the e-return system, they can file a paper return if the Additional/Joint Commissioner of Taxes agrees. They must send a written request with specific reasons to the Deputy Commissioner of Taxes by the 31st of October, 2025.

How Bangladesh Consultant Can Help?

If you need assistance with filing income tax return online in Bangladesh, you can contact National Board of Revenue. If you need further support, the professionals from Bangladesh Consultant can help.

FAQs-All Your Questions Answered at a Glance

To submit your income tax returns online, you must register with the e-Return system. For registration, you will need

- Your National Identity Card (NID).

- A mobile phone number with a SIM card registered in your name via biometric verification.

- A Taxpayer Identification Number (TIN).

After successfully registering for the first time, you can sign in and update your profile information as needed. Then, step by step, you can enter your income (by category), investments, household expenses, assets and liabilities, and tax payment details to easily file your tax return online. When entering information, ensure accuracy by consulting all supporting documents.

You need your TIN and password to sign in your online tax return portal. You will create your password when registering at NBR website. You can sign in anytime using your TIN and password, and you can change your password if necessary.

You need your TIN, National ID card, and a mobile number with a SIM card registered in your name via biometric verification. To check if your mobile number is registered under your name, dial *16001# and follow the prompts.

Go to ETax NBR website and click on I am not registered yet. Then enter your TIN and mobile number, click Verify, and you will receive a 6-digit OTP on your phone. Enter the OTP, set your password, and click Register to complete registration.

Yes, you can. The mobile number you used when obtaining your TIN is not important. You can register with any mobile number that is registered in your name via biometric verification. After registration, you can also update your mobile number in the e-Return system.

Your password must be at least eight characters long and contain at least one lowercase letter, one uppercase letter, one digit (0–9), and one special character (e.g., @, #, $, %, *, &, !). If using a laptop or desktop, the system will guide you. If you forget your password, click Forget password, and you will receive an OTP on your mobile to reset it.

Dial *16001# and enter the last four digits of your NID number. The mobile operator will reply with the number of mobile SIMs registered under your NID.

For any issues with your online tax retun Bangladesh, you can contact the National Board of Revenue (NBR) Call Centre at 09643 717171 (available 9:00 AM – 5:00 PM on working days). You can also email via the eTax Service Centre portal or get assistance at your local tax zone during Tax Service Month.

While the system has many user-friendly features, some are not available on mobile devices. It is recommended to use a laptop or desktop for best results.

This year, you do not need to upload any documents for online filing. Keep the necessary documents with you while filling in the fields accurately. Once you submit your return online, your assessment will be completed automatically, and you will receive an acknowledgement slip. A tax certificate will also be generated instantly. You can print the acknowledgement slip, tax certificate, and a copy of your return anytime by clicking the Tax record menu.

No, after submitting your return online, you do not need to resubmit it to your tax circle. Your tax assessment will be completed automatically upon online submission.

Follow these steps:

a) Go to www.etaxnbr.gov.bd, where you will see three menus on the left side — Home, Return submission, and Tax record.

b) Click on Return submission. The system will show your assessment information and heads of income.

c) Proceed step by step. The software will guide you. If you do not understand a term, refer to the user manual first. Most options have a question mark icon that provides detailed explanations. If still unclear, call the call center for assistance.

There are seven steps:

1. Assessment — Provide basic information:

o Assessment information: Assessment year, income year, etc.

o Heads of income: Select applicable categories — salary, rental income, agricultural income, business income, capital gains, income from financial assets, income from other sources.

o Additional information: Main source of income and other income.

o IT-10B requirements: Asset details such as property, vehicles, etc.

2. Income — Enter details of income by category.

3. Rebate — Provide information on eligible investments (life insurance, DPS, savings certificates, GPF, etc.).

4. Expenditure — Provide your annual expense details.

5. Assets & Liabilities — Enter detailed information on all assets and liabilities.

6. Tax & Payment — View your income summary, tax computation, and payable tax. Update with details of source tax, advance tax, excess tax from previous years, and tax paid with the return. You can pay online via mobile banking, internet banking, or cards.

7. Return View — Review, save, and submit your return. You can also partially save and submit later. After submission, you can download and print the acknowledgement slip, return, certificate, and payment receipt at any time.

Yes. In the Tax & Payment section, you can update your payment details and submit your return.

In Tax & Payment, click Update Tax Payment Status to open the e-Return Ledger. Select the relevant payment type (source tax, advance tax, tax paid with return, adjustment for previous excess tax). Fill in the required details — payment authority, challan or certificate number, date, bank name, branch, and amounts. If the challan or certificate is only for you, the Challan/Certificate amount and Claimed amount will be the same. For joint amounts, enter only your portion in Claimed amount.

In Tax & Payment, click Update Tax Payment Status. For government employees paid via iBAS, select Salary (iBAS) and search to display deducted amounts. For others, select Salary (Others) and enter challan or certificate details, along with amounts. If the challan covers multiple people, enter only your portion in the Claimed amount.

In Tax & Payment, click Update Tax Payment Status, select Claim source tax, then Sanchaypatra/BankFI Interest/Other (Dividend – Section 117) and choose Sync from Income. Enter the necessary details and save. Ensure you have already entered the related income in the Income section.

If tax has been deducted at source, select Other source (with TDS) under Income from other sources. If no tax was deducted, select Any other income.

In Tax & Payment, click Update Tax Payment Status, select Claim source tax, then Sanchaypatra and Sync from Income. This will display the income details you entered earlier under Financial Assets > Sanchaypatra. Enter the necessary details and save. If income details were not entered earlier, Sync from Income will not work.

In Tax & Payment, click Update Tax Payment Status, select Claim source tax, then Sanchaypatra and Sync from Income. In the TDS available section, enter only your portion under TDS claim (in case of joint holder your portion only).

In the Tax & Payment section, click Update Tax Payment Status. Under Claim AIT, select AIT on Car, enter the Unique Key (Transaction No.), search, and then save the information.

Yes. If you have unpaid tax, it will appear in the Tax & Payment section under Payable, and the Pay Now button will be active. You can click Pay Now to pay via e-Challan or the Sonali Bank gateway using mobile banking (bKash, Rocket, Nagad), internet banking, debit, or credit cards.

In Tax & Payment, click Update Tax Payment Status. In the left menu, select Adjustment of tax refund and enter the excess tax paid in previous years. This adjustment will be effective only after verification by the Deputy Commissioner of Taxes (DCT).

This occurs because your gender was mistakenly set to “Male” during TIN registration. You can correct it in the TIN system under Edit/Correct/Update, then go to your e-Return profile and click Sync with TIN. If needed, contact the call center for assistance.

- i) You can file your return from home without visiting the tax office.

ii) You can print/download your TIN certificate.

iii) You can print/download your return and tax certificate.

iv) You can download the acknowledgement slip as proof of submission.

v) You can print/download payment challans for taxes paid through the system.

vi) You can access records of returns filed in previous years.

If you are unable to file online due to registration issues, you may apply to the relevant Deputy Commissioner of Taxes (DCT) by 31 October 2025 with valid reasons. With approval from the Additional/Joint Commissioner of Taxes, you can submit a paper return instead.

All regular individual taxpayers must file their returns online. However, the following are exempt:

a) Senior taxpayers aged 65 years or above

b) Physically disabled or specially-abled taxpayers

c) Bangladeshi taxpayers residing abroad

d) Legal representatives of deceased taxpayers

No. In the Assets & Liabilities section, click Autofill to import last year’s data. You can edit, delete, add, or update the information as needed.

This happened because you did not submit the return online last year — the system did not save your data.

This occurs because you entered different information in the Income section and the Update Tax Payment section. Ensure the same information is entered in both. Alternatively, in the e-Return Ledger, for Bank TDS, click Sync from Income to automatically display previously entered data, select it, and update easily.

Yes. Various tax zones provide assistance with e-Return filing during Tax Service Month.

Ensure you are using the transaction ID from the bank slip for car tax paid between 01-07-2024 and 30-06-2025. Taxes paid before or after this period cannot be adjusted in this year’s return. If you still face issues, contact the call center for assistance.

In the Employment income section, use Add Employment to enter the details and income for each job separately.

No, surcharge does not apply to you.

This can happen if you enter an incorrect registration number or date, or if the savings certificate was purchased before 30-06-2019. However, if you correctly enter income details in Income from Financial Assets and then click Sync from Income in the e-Return Ledger, the problem will not occur.

No. Show the value declared in the previous year. For new assets, show the actual purchase price.

Update the information in the TIN system using the Revalidate option, then in e-Return, go to your profile and click Sync with TIN. Contact the call center if needed.

Show it as business income. For regular income, enter it under Regular Business Income. If tax is deducted at source, enter it under Business Subject to Minimum Tax >> Profession/Consultancy/Other Services.

Yes, except for assets that have been liquidated or transferred. Show all remaining assets.

Save your work, log out, then log back in and check the Tax & Payment page. If the unpaid status remains, contact the call center.

You can submit a corrected (amended) return online within 180 days of submission. However, you can only submit a correction once.

You should select Dhaka North City Corporation.

They are considered private employees.

Yes, your information will be completely safe. The National Board of Revenue (NBR) legally ensures the confidentiality and security of your data.

Yes, you can. The Deputy Commissioner of Taxes (DCT) will provide the certified copy.

Yes, you can submit it online after the deadline following the regular procedure.

Comments are closed