How to Get VAT Registration in Bangladesh

VAT falls under the category of consumption tax that the Government collects from a business’s sales of goods and services. In Bangladesh, eligible businesses are obligated to submit VAT returns to the National Board of Revenue (NBR). Failing at it is regarded as a serious violation

Read MoreComplete Guide to Filing Corporate Tax Returns in Bangladesh

Filing corporate tax returns in Bangladesh is crucial for all types of Businesses. It’s how they align with the law and observe due duties. Any negligence and failure in paying the imposed tax on time and through the actual process puts a red mark on a

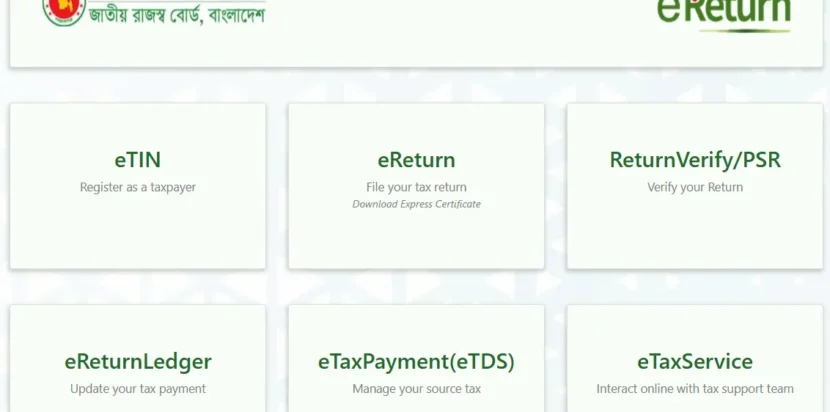

Read MoreOnline Tax Return in Bangladesh- How to File Income Tax Returns in 2025

Why File Online Tax Return in Bangladesh? Updated 20th Aug 2025 When it became mandatory for individual taxpayers in certain areas to file their income tax return online last year in 2024, there was a huge response. More than 1.7 million taxpayers filed their income tax

Read MoreCommon Tax Filing Mistakes Businesses Make in Bangladesh

In Bangladesh, every business entity must file taxes. More than a responsibility, it’s a legal requirement. Neglecting or failing to pay it duly only extends the due amount by adding fines, interest, and bans on licenses, necessitating renewals. During the filing of a tax return, businesses

Read MoreHow to Obtain a TIN Certificate in Bangladesh

A Tax Identification Number (TIN) is essential to make safe and trackable money transactions. It also turns you into a potential tax-paying citizen. Beyond that, you get the right to claim many government-provided conveniences. Banks and brands want their consumers to provide TIN numbers when opening

Read MoreWhat Services Do Tax Consultants Provide In Bangladesh?

Tax consultants play a very important role in helping businesses and individuals comply with tax laws and manage their tax liabilities. They also give out expert advice, plan taxing strategies, and help in filing tax returns. In other words, tax consultants will help you with any

Read More