Table of Contents

ToggleAs the fossil fuels are depleting and causing environmental hazards, the world is advancing towards renewable energy (RE) sources for better, cleaner, and secured energy sources. Bangladesh, a small country in South East Asia with huge potential, is also progressing towards cleaner and safer energy sources. Albeit, late compared to other developed countries, it is better late than never. The Chief Advisor of the Interim Government of Bangladesh, Professor Dr Mohammad Yunus are encouraging the investors to invest in this high-growth emerging RE sectors. The country at the moment not only growing fast economically, but also experiencing a strategic transformation toward a future with clean and safer energy.

At present, Bangladesh is experiencing high energy demand due to economic expansion and large industrial development. The government has also mandated and set a target to generate 40% electricity from RE sources by 2041. Moreover, the government already made policy reforms and opened avenues for Public Private Partnerships (PPPs), foreign direct investments (FDIs) and green financing. In a global race for sustainable energy dominance, Bangladesh offers first-mover advantages in a market that is still nascent but rapidly evolving. For international investors, this is not just another market—it’s the next renewable energy frontier.

Energy Scenario of Bangladesh

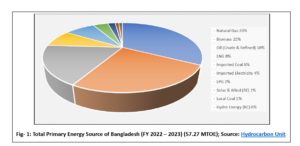

The latest report on ‘Energy Scenario of Bangladesh’, prepared and published by the Hydrocarbon Unit of the Government of Bangladesh, portrayed that Bangladesh is highly dependent on natural gas and biomass for its energy production. For a clear understanding of its dependence on natural and biomass please refer to the pie chart.

The pie chart in Figure- 1 illustrates the distribution of total primary energy sources used in Bangladesh during the Fiscal Year 2022-23, which amounts to 57.27 million tons of oil equivalent (MTOE). The chart depicts that natural gas the primary energy source of Bangladesh which contributes the largest share of 33% or 18.63 MTOE to the country’s total energy usage. Biomass is the second largest source which contributes 25% or 14.32 MTOE to the total energy consumptions. Oil, including both crude and refined products accounts for 18% or 10.49 MTOE of the total consumptions. Both LNG (Liquified Natural Gas) and imported coal contributes shares of 8% each or 4.72 MTOE and 4.49 MTOE respectively to the total consumption of energy. Imported electricity adds another 4% or 1.96 MTOE to the total energy. LPG (Liquified Petroleum Gas) contributes 2% or 1.29 MTOE. Renewable energy sources for instance solar and wind together provide 1% or 0.71 MTOE energy and local coal adds a further 1% or 0.49 MTOE to the total energy consumption in Bangladesh. Hydro based renewable energy contributes a microscopic share less than 1% or 0.17 MTOE. Overall, the figure features that energy sector is still highly dependent on fossil fuels and traditional biomass whilst renewable energy sources occupying a very trifling shares of the total energy consumption.

Expanding and investing in the RE sector has a trifecta of benefits; for example, it significantly reduces the environmental impact and saves national gas reserves, it has the lowest operational cost and finally, it substantially enhances energy security. Furthermore, where the fossil fuels prices are capricious and the reserves both of fossil fuels and foreign currency are continuously depleting, RE always provides a sustainable and cost-effective source. Therefore, in order to build a resilient, low carbon emission future, investing in RE sectors not only a necessity it is an economic imperative.

Government Policy Support and Incentives

Fiscal Benefits: The government is equipped with a robust policy framework to instigate foreign investors to invest in RE sector. On 26th November 2024, the National Board of Revenue (NBR), the apex tax administration of Bangladesh, issued a Statutory Regulatory Order (SRO), granting tax benefit for investments in RE sectors. The SRO stated that if the RE plants or the company commences commercial production of clean electricity between 1st July 2025 and 30th June 2030, the company/plants would enjoy a 100 percent tax holiday for 10 years, subsequently, a 50 percent exemption for 3 years and a further 25 percent for 2 years. This tax benefits would take effect from 1st July 2025. The SRO also stated that to take the advantage the company or the producers must avail approval, a No Objection Certificate (NOC) from the Power Division under the Ministry of Power, Energy, and Mineral Resources of Bangladesh for each project or power plant. Furthermore, on top of the tax benefits, the investors of RE projects might be eligible for import duty exemptions on capital machineries, raw materials for renewable energy projects.

Legal Protections for Foreign Investors and Repatriation policies: The Government of Bangladesh safeguards the foreign investments through an extensive legal framework, for instance, the Foreign Private Investment (Promotion and Protection) Act 1980, which not only protects the investments against expropriation and nationalization under section 7 of the Act; but also ensures an equitable atmosphere for the foreign investors under section 4. It also allows repatriation of investments and the profits under section 8.

Furthermore, Bangladesh contracted Bilateral Investment Treaties (BITs), with 30 countries which provide an extra layer of protection for the foreign investments and offers Alternative Dispute Resolution for the foreign investors.

Simplified Investment Process: The Government of Bangladesh as well as Bangladesh Investment Development Authority (BIDA) have taken pragmatic initiatives to facilitate the ease of doing business in Bangladesh. For instance, BIDA has introduced One Stop Service (OSS) which provides a single window solution for the investors to obtain compulsory approvals, licenses and permits.

On top of that, the government has implemented ‘Net Metering’ policy for encouraging rooftop solar panel installations where the installers could vend surplus electricity to the national grid for money, which eventually enhances the feasibility of rooftop solar panels installations.

Key Investment Opportunities

RE sector of Bangladesh is perfect and ready for foreign investments which offers a blend of support from the government, a suitable and strategic location, and most importantly, a growing energy demand. The government emphasizes on solar energy, wind energy, waste-to-energy, and hydropower to boost the electricity production to meet the increased demand due to industrialization. At present, as Sustainable and Renewable Energy Development Authority (SREDA) reported, Bangladesh is generating 1562.12 MW of electricity from renewable energy sources. The following chart would describe the total energy is being generated at the moment in Bangladesh.

| Technology | Off-Grid (MW) | On-Grid (MW) | Total (MW) |

| Solar | 377.15 | 890.98 | 1268.13 |

| Wind | 2 | 60.9 | 62.9 |

| Hydro | 0 | 230 | 230 |

| Biogas & Biomass to Electricity | 1.09 | 0 | 1.09 |

| Total | 380.24 | 1181.88 | 1562.12 |

The rest of the article would briefly discuss about the current policy and ongoing projects to help the investors to make an informed decision.

Solar Energy- Harnessing the Sun

Due to the geographical location and the Tropic of Cancer bisecting the country, Bangladesh receives abundant sunlight throughout the year. On average, Bangladesh observes over 300 sunny days every year which leveraged the natural advantage through solar home systems (SHS) and solar parks. SREDA reported there are about 67 solar projects in Bangladesh at the moment, either completed, under construction, or in planning stages and 9 solar parks were rejected by the government whilst on the planning stages. Once all the perks are completed, Bangladesh would be capable to generate approximately 5,000 MWs of solar electricity.

However, it definitely does not end there. Bangladesh needs more solar energy projects to meet the growing demands of electricity. Therefore, the growing demand coupled with government supports and incentives, and overall abundant solar potential makes the investments in solar projects in Bangladesh highly lucrative. The followings are the key factors which explain why it is lucrative to invest:

High Energy Demand and Market Growth: In the Annual Report published by the Bangladesh Power Development Board (BPDB) in 2024 reported that energy demand in Bangladesh is rising by 4.68% annually due to the population growth and industrial expansion. On top of that the country is desperate to switch from the fossil fuels to renewable energy. The main reasons for this shift are to reduce the import dependency on the neighbouring countries. In the FY 2022-23 Bangladesh imported 2,656 MW of electricity from Tripura (India), Adani Power Ltd, (Jharkhand, India) and other Indian sources, the report stated. The government due to geopolitical issues, sudden fluctuations in the rates of the power, and to increase energy security, decided to reduce its reliance on India. Other major reasons of this shift are solar or renewable energy are cost effective in the long run and it is environment and climate friendly as there are less carbon and greenhouse gas emission. Therefore, as an entrepreneur and investor, it is time you invested in RE sectors in Bangladesh.

Supports and Incentives: To accentuate the point, let us reiterate the incentives offered by the government. If the company commences commercial generation of electricity between 1st July 2025 and 30th June 2030, the company would receive a 100% tax exemption for the first 10 years, subsequently, a 50 percent exemption for 3 years and a further 25 percent for 2 years. On top of that you may have further reductions in tax and duty for importing raw materials and equipment for the project.

Solar Parks and Private Sector Involvement: Foreign investors as well as local investors are also highly interested to invest in the solar projects. The Asian Development Bank signed a $121.55 million finance package with Dynamic Sun Energy Private Ltd to build and operate a 100 MW national grid-connected solar PV plants in Pabna, Bangladesh. It is the country’s first private sector solar PV facility. The government is open to all sorts of investments in RE sectors, be it a public private partnership (PPP), private, or joint venture.

Strong Solar Potential: Bangladesh, annually observes 300+ sunny days and the average solar potential is 4.59 Global Horizontal Irradiance (GHI). GHI is a crucial parameter and it is measured as the total amount of solar radiation received on a horizontal surface. As Bangladesh has mostly flat landscape and high GHI, it the best place for large scale solar plant installations.

As Bangladesh is planning to embrace a cleaner, sustainable and resilient energy source, solar energy radiates a beacon of hope and profitability. Robust government supports and incentives, ever growing energy demand, and abundant sunlight make the investments more profitable. In Bangladesh, it is not only your investment that makes a profit, you would also be a part of shaping the country’s future. The sun is shining, now is the time to harness its power.

Wind Energy: Exploring Coastal and Offshore Potential

Long coastal line along the Bay of Bengal, approximately 710 kms and large flat landscape with numerous rivers make Bangladesh a perfect country for wind energy projects. In a report published in June 2024 in joint collaboration of US Agency for International Development (USAID), US Department of Energy’s National Renewable Energy Laboratory (NREL) and Bangladesh government’s SREDA stated that offshore wind speeds are higher than onshore wind speeds in Bangladesh and the annual average wind speeds range between 6.3 m/s to 8 m/s at 160 meter hub height which is nearly double the minimum cut-in speed required to rotate the turbines.

Furthermore, the World Bank’s South Asia Wind Power Mapping Project is recorded in the report titled Solar and Wind Resource Implementation Plan – Bangladesh. According to this report, Bangladesh has the capability of over 20,000 MW of technical wind potential and no less than 6,000 MW viable electricity with present technologies in the offshore and coastal areas. Moreover, wind energy when it is connected to the national grid, it would help the to meet the peak demands and lessen reliability on imported and expensive fossil fuels. Unlike solar energy, wind energy can produce electricity in both day and night, and even in northwesters and monsoon seasons.

Advantages and Disadvantages of Wind Power Deployment in Bangladesh: The first and the foremost advantage of wind energy is it reduces the import costs of fossil fuels. It emits zero greenhouse gas or pollutants in the atmosphere. Whilst it reduces the dependency on the fossil fuels, it also creates job opportunities for the local people and improves the economy a lot.

The first commercial wind power plant of Bangladesh, located at Cox’s Bazar, started full-scale operation on 8th March 2024. With the capacity of 60 MW, the electricity produced by the plant is being supplied straight to the national grid. The officials of the project stated in the article that the plant is providing Bangladesh 145 million kWh of clean electricity each year while cutting coal consumption by 44,600 tons and reducing carbon emissions by 109,200 tons. It provides electricity to 100,000 households of the country. On top of that, whilst the plant was under construction, it employed 1,500 local people and once completed, it requires more than 30 people for operations and maintenance.

However, all these benefits of course do not come free of disadvantages. The first thing which hindrances widespread of wind power plants is that it is too expensive to install especially in the offshore areas. For instance, to generate 60 MW, the first wind power plant itself costed USD 116.51M, albeit being installed onshore. This financial impediment decelerates the development of wind power projects especially in a developing country like Bangladesh. Therefore, extensive foreign investments are required for more projects. Furthermore, the current national grid infrastructure is not prepared to manage intermittent and decentralized nature of wind power. To fit in more wind power plants, it would require extensive upgradation in transmissions and distributions which would include establishing sub-stations, more flexible grid and storage capabilities. Whilst, wind power provides strong promises, especially in the off-shore wind projects, it raises serious environmental concerns. It would have negative impacts on marine biodiversity, fish migration routes, and marine ecosystem which are vital and sensitive to seaside communities.

Hydropower in Bangladesh – the Untapped Potential

Bangladesh has relatively a flat topography with mountains in the east. The hilly region hold untapped potential in hydropower generation. Nation’s first and only hydropower plant, Kaptai Hydropower Plant is located at Kaptai in the southeastern hilly region of Rangamati district, with installed capacity of 230 MW. The plant was inaugurated in 1962 with initial capacity of 80 MW and gradually increased to 230 MW by installing more generators. The dam is an earth-filled embankment on the Karnaphuli river. The hilly region also known as Chittagong Hill Tracts (CHT) comprising Rangamati, Khagrachari, and Bandarban, has potential for medium to large- scale hydropower projects on the Sangu and Matamuhuri rivers.

Biomass and Biogas – Waste to Electricity (WtE)

Biomass energy is derived from the organic matters encompassing plants, animals, wood chips and animal dung which are burned to produce electricity. On the other hand, biogas is primarily methane, generated by breaking down the organic matters through the anaerobic digestion of organic waste like animal waste, food scraps, manure and sewage. WtE sources are widely available in Bangladesh since Bangladesh has an agrarian economy and large population.

Bangladesh has abundant feedstock like agricultural residues and livestock waste in particular in the rural areas where cattle farms are plenty. WtE sources cut organic waste and environmental pollutions whilst create job opportunities in the rural areas where the job opportunities are scarce. WtE sources also have the prospect of providing electricity in the off-grid regions and emit less greenhouse gases than fossil fuels if managed appropriately.

Competitive Advantage for Investors

Bangladesh has a unique fascinating blend of strategic geographic and demographic advantages, favourable economic efficiency and government support, which makes the investment lucrative and profitable.

Firstly, the RE sector of Bangladesh is mostly untapped market. Currently, total installed power capacity of Bangladesh is 22,515 MW, of which only 2.93% or 650 MW are incorporated from renewable sources. However, the government set an ambitious target to generate 15% electricity from RE by 2030, 40% by 2041 and 100% by 2050. This gap between current capacity (2.93%) and the future goals creates a first-mover advantages for the investors.

Secondly, Bangladesh has planned Integrated Energy and Power Master Plan (IEPMP), which outlines a roadmap for clean energy expansion. The investors intending to invest in RE sectors in Bangladesh enjoys numerous fiscal benefits and legal protection from the government as discussed above. To reiterate a few of those incentives, investors would have tax holidays, duty exemptions, feed-in tariffs, net metering policies and of course low-interest financing. For instance, Infrastructure Development Company Limited, a government owned specialized non-bank financial institution, finances RE infrastructure projects in Bangladesh at very low interest rates.

Thirdly, as mentioned before, Bangladesh has strategic geographic and demographic advantages. Since, it is just under the Tropic of Cancer, it receives high solar irradiance throughout the day. It is estimated that Bangladesh observes over 300 sunny days over the year which is a plus point for solar power projects. Again, Bangladesh has a large coastal area with average wind speed between 6 m/s to 8 m/s which is also advantageous for wind power projects. Furthermore, it is needless to say that Bangladesh has a huge pool of young and skilled workforce. The average wage of Bangladeshi workers is also cheaper compared to other countries in Asia. It is reported by the US Department of Labour that that average wages for RMG and most of the sectors is BDT 12,500 which is equivalent to just over USD 100 depending on the currency exchange rate. To know more about the skilled workforce of Bangladesh and the rise of Chinese investment in Bangladesh, please check out our previous blog on Chinese Investment on the Rise in Bangladesh.

Lastly, the long-term financial returns are immense. Since the country is transitioning towards cleaner energy under its Vision 2041 goals, the early investors are strategically positioned to be benefitted from multiple ROI drivers supported by policy, economics and the market demand.

How Bangladesh Consultant Can Help Investors Succeed in RE Sector

Navigating a new market – especially in a highly controlled and tentatively complex sector, entails more than capital. The investment requires local insight, strategic guidance, regulatory navigation and of course compliance with the legal structure of the country. This where, we step in to form a bridge between the foreign investors and the Bangladeshi market. Our support and services ranges from company formation, licensing, regulatory approvals to compliance with the tax, VAT, payrolls and so on. With deep relationships across bodies such as SREDA, BIDA, RJSC, BPDB and other government bodies; we support the clients to start their business in Bangladesh with ease and hassle free.

Conclusion: Why Now Is the Time to Invest in Bangladesh

At this moment, Bangladesh is standing at a critical stage, where power demand, climate preservation, and the economic ambition intersect. With only 2% of the country’s energy mix generates from renewable sources, yet a huge goal of 40% by 2041 put forward ample but rare opportunities for the investors to enter the market poised for rampant growth.

The cost of inaction is surging since; all the incentives would be available to the investors who commence commercial production of energy by 30th June 2030. Furthermore, investors who invest in the unsaturated market of RE in Bangladesh, can achieve long-term Power Purchase Agreements (PPA) along with all the incentives, and would be able to tap into one of the most competitive labour markets in Asia. The government of Bangladesh also laid multiple policies, for instance, IEPMP, tax incentives, net metering and so on, and aligned them with international fundings from World Bank and ADB to create a prolific investment environment.

Unlike the over competitive markets, where the demand reached its peak capacity and growth margins are compressed, Bangladesh presents significant demand with strong growth potential and an environment that proactively supports foreign investors for collaboration. Since, the shift has started, groundwork has laid, and the demand for renewable power sources are surging, now is not just the right time; it is the smart time you invested in the renewable energy future of Bangladesh.

Comments are closed