© Copyright 2025. All Rights Reserved by Bangladesh Consultant

Compliance Without Compromise – Your Path to Financial Excellence

Payroll Simplified, Success Amplified

Top Business Consulting Firm In Bangladesh

At Bangladesh Consultant’s guidance, you are safe from any kind of legal and financial trouble! We are committed to providing logistical services designed to support your business at every stage of its growth. Entity Formation service ensures your business is legally established and structured for success. Also, we handle Payroll Services precisely, making timely and accurate compensation for your employees. Actuarial Valuation Services offer expert analysis to manage risks and ensure financial stability. With our Secretarial Services , your compliance and administrative tasks are efficiently managed. We deliver to-the-point Accounting Services to keep your finances in order. The Tax and VAT Compliance services ensure you meet all regulatory requirements seamlessly. Licensing services help you obtain necessary permits, and our Auditing Services provide thorough financial assessments. Robust Employee Benefits solutions to attract and retain top talent. Attestation Services guarantee the authenticity of your documents, and our Asset Valuation for Visa Purposes supports your immigration processes. We believe in: • Premium Consultation • Powerful Commitment • Favorable Outcome We have 98% client retention rate for promising delivery. Trust us to be your dedicated financial partner. Contact us for expert guidance in business consultancy.

-

Consulting Success98%

-

Worldwide Clients120+

Our Top Services

Our expert lawyers specialise in navigating through the legal intricacies of company formation. You can trust our lawyers to incorporate your desired company in Bangladesh with precision.

Our experienced team are ready to provide the best payroll services starting from salary calculations to complex tax filings. We take the stress so that you do not have to.

You could rely on our expert actuaries to assess risks and financial projections which would assist you in the sustainability of a better pension plan for a long-term and making informed decisions with confidence.

Our skilled team offers maintaining your corporate records and managing the complex administrative intricacies seamlessly. We take care of the minutiae whilst you focus on propelling your business forward.

Experienced team at Bangladesh Consultant offers expert accounting services for your company, tailored fit to the unique needs of businesses in Bangladesh. You can blindly trust our skilled team to comply with bookkeeping, financial reports and government rules.

Our dexterous tax lawyers are well equipped to provide tailored tax compliance services for the regulatory landscape of Bangladesh. Trust our lawyers to keep your business tax compliant and avoid potential penalties.

Our service offers expert guidance to ensure compliance with VAT regulations of Bangladesh. We manage registrations, filing and reporting with accuracy and efficiency.

To ensure financial transparency and government compliance, our certified auditors meticulously asses your financial records and transactions and provide accurate, reliable and transparent auditing services.

To enhance workplace contentment and draw pool of top talents, our comprehensive employee benefits solutions offer provident funds, gratuity funds schemes and pension plans suitable for your business growth. Trust us to create a remunerative atmosphere in your business.

Ensure credibility and legal validity with our professional attestation and notary services. Whether you need document authentication, witness signatures, or legal certifications, we offer reliable solutions.

Our professional asset valuation services provide accurate assessments of your assets, tailored specifically for visa applications. Whether you’re applying for an investor visa, family reunification, or any other immigration purpose, trust us to evaluate your assets meticulously. Our certified valuations enhance your visa application’s credibility and ensure compliance with visa requirements.

Witness the Innovative Approach in Finanical Solution

-

Expert Business Consultation

Become a mastermind of business and administration with our service. Get yourself ahead of others in this competitive digital era.

-

24/7 Customer Support

Contact us anytime for your legal and financial need. We have hotline service to recover your from urgent situations.

OUR POPULAR SERVICES

Our most recent Completed Projects

Recruitment

Payroll Services

We assist in yor payroll service. In 2024, a mid-sized company struggled with payroll errors and compliance issues. Our Payroll Services streamlined their payroll process, ensuring accuracy and timely payments. Within 3 months, compliance issues were resolved, and administrative workload decreased by 40%.

Contact Us

Recruitment

Auditing Services

A manufacturing company engaged our Auditing Services to ensure financial compliance. Through our deep audit process, we identified discrepancies, streamlined their financial reporting, and provided actionable insights, resulting in improved accuracy and trust with stakeholders. We optimized operational efficiency.

Contact UsLooking for a First-Class

Business Consultant?

Request a Call back

-

Business advices given over 30 years500+

-

Business Excellence awards achieved30+

Latest Blog

News & Update

What are the Key Benefits of Choosing Bangladesh Consultant?

Bangladesh Consultant is a premier financial consulting firm in Bangladesh due to its comprehensive, client-focused approach and exceptional service delivery.

Here’s what makes it unique:

1. Comprehensive Service Portfolio

Bangladesh Consultant offers extensive services, including entity formation, payroll management, tax and VAT compliance, accounting, auditing, and more. This holistic approach ensures that businesses can rely on a single partner for all their financial and legal needs, simplifying operations and enhancing efficiency.

2. Proven Expertise

The firm’s team comprises seasoned professionals with deep expertise in navigating Bangladesh’s regulatory and financial landscape. From legal intricacies of company formation to complex actuarial valuations, Bangladesh Consultant provides precise and reliable solutions tailored to each client’s needs.

3. High Client Retention Rate

With a 98% client retention rate, Bangladesh Consultant demonstrates its ability to deliver value and build long-term relationships consistently. This reflects the trust and satisfaction of its clients across various industries.

4. Focus on Compliance and Risk Management

Bangladesh Consultant excels in ensuring businesses remain compliant with Bangladesh’s regulatory requirements. Services like tax compliance, VAT management, and secretarial support help clients avoid penalties while maintaining smooth operations.

5. Tailored Solutions for Growth

The firm doesn’t just offer services; it provides solutions designed to support business growth at every stage. Whether it’s helping startups establish a strong foundation or assisting established firms with advanced financial strategies, Bangladesh Consultant adapts to the unique needs of each business.

6. Commitment to Excellence

Bangladesh Consultant operates on the principles of premium consultation, powerful commitment, and delivering favorable outcomes. This philosophy drives the firm to maintain high standards in every aspect of its service delivery.

7. Streamlined Processes

By handling administrative complexities like licensing, payroll, and compliance efficiently, Bangladesh Consultant allows businesses to focus on their core operations without being bogged down by logistical challenges.

8. Client-Centric Approach

The firm’s friendly yet professional approach ensures clients feel valued and supported throughout their journey. Bangladesh Consultant positions itself not just as a service provider but as a trusted partner invested in its clients’ success.

Bangladesh Consultant distinguishes itself through its comprehensive services, expertise, reliability, and unwavering commitment to client success – making it the go-to financial consulting firm in Bangladesh.

What unique services does Bangladesh Consultant offer compared to other consulting firms in Bangladesh?

Bangladesh Consultant offers several unique services that differentiate it from other business consulting firms in Bangladesh:

1. Comprehensive Entity Formation Services

Expert Legal Guidance: Bangladesh Consultant provides the best business consultation in Bangladesh specialized legal services for company formation, ensuring that businesses are legally established and structured for success in Bangladesh’s regulatory environment.

Precision in Documentation: Their team ensures that all legal documents are meticulously prepared, reducing the risk of errors and compliance issues.

2. Actuarial Valuation Services

Risk Management: Bangladesh Consultant offers actuarial valuation services to assess risks and financial projections, helping businesses make informed decisions about pension plans and long-term financial sustainability.

Customized Financial Planning: This service is tailored to meet the unique needs of each business, providing a competitive edge in financial management.

3. Robust Employee Benefits Solutions

Attractive Talent Retention: By offering comprehensive employee benefits such as provident funds, gratuity funds, and pension plans, Bangladesh Consultant helps businesses attract and retain top talent in a competitive market.

Enhanced Workplace Satisfaction: These solutions contribute to a remunerative work environment, boosting employee morale and productivity.

4. Professional Attestation and Asset Valuation Services

Document Authentication: Bangladesh Consultant provides reliable attestation services for document authentication, ensuring legal validity and credibility.

Accurate Asset Valuation: Their asset valuation services are specifically designed for visa applications, enhancing the credibility of immigration documents and ensuring compliance with visa requirements.

5. Tailored Accounting and Tax Compliance Services

Customized Financial Solutions: Bangladesh Consultant delivers accounting services tailored to the unique needs of businesses in Bangladesh, ensuring compliance with local financial regulations and tax laws.

Efficient VAT Management: They manage VAT registrations, filings, and reporting with accuracy and efficiency, reducing the risk of penalties and ensuring seamless compliance.

How does Bangladesh Consultant ensure compliance with legal and financial regulations?

Bangladesh Consultant ensures compliance with legal and financial regulations through a structured approach emphasizing proactive management and adherence to regulatory standards. Here’s how they achieve this:

1. Expertise in Regulatory Frameworks

Bangladesh Consultant employs a team of experts who are well-versed in Bangladesh’s legal and financial regulatory landscape. This expertise allows them to guide businesses through complex compliance requirements, ensuring that all operations are aligned with applicable laws and regulations.

2. Comprehensive Compliance Services

The firm offers a broad range of services to support compliance, including tax and VAT compliance, secretarial services, and auditing services. These services are tailored to ensure businesses meet all necessary legal and financial obligations, reducing non-compliance risk.

3. Risk Management and Assessment

Bangladesh Consultant conducts thorough risk assessments to identify potential compliance risks. They develop and implement strategies to mitigate these risks, ensuring businesses are prepared for regulatory audits and inspections.

4. Continuous Monitoring and Updates

The firm continuously monitors changes in legal and financial regulations, updating its services and advice to reflect these changes. This proactive approach ensures that clients remain compliant even as regulatory environments evolve.

5. Training and Awareness

While not explicitly mentioned, Bangladesh Consultant likely emphasizes the importance of training and awareness among clients and their employees. This includes understanding compliance policies and procedures, which is crucial for maintaining a culture of compliance within organizations.

6. Integration with Corporate Governance

Compliance is often integrated into broader corporate governance practices, including decision-making, control, and oversight mechanisms. Bangladesh Consultant likely supports clients in establishing robust governance structures that embed compliance as a core component.

Bangladesh Consultant ensures compliance by combining expert guidance, comprehensive services, and a proactive approach to managing regulatory risks. This approach helps businesses in Bangladesh maintain legal and financial integrity while focusing on growth and development.

How does Bangladesh Consultant support businesses in obtaining necessary permits and licenses?

Bangladesh Consultant supports businesses in obtaining necessary permits and licenses by providing streamlined and efficient licensing services.

Here’s how they assist:

1. Expert Guidance

Bangladesh Consultant employs experts who are well-versed in Bangladesh’s regulatory landscape. They guide businesses through the complex process of obtaining permits and licenses and ensure compliance with all legal requirements.

2. Simplified Application Process

The firm helps businesses navigate the often cumbersome permit and license application process. Bangladesh Consultant reduces the administrative burden on businesses by handling paperwork and ensuring that all necessary documents are in order.

3. Timely Assistance

Bangladesh Consultant ensures that businesses receive timely assistance, helping them avoid delays in obtaining necessary permits. This is crucial for companies looking to launch or expand operations quickly.

4. Compliance Management

Beyond obtaining permits, Bangladesh Consultant also helps businesses manage ongoing compliance requirements. This includes ensuring that all licenses are renewed on time and that companies remain compliant with changing regulations.

5. Strategic Planning

The firm provides strategic advice on how to structure permit applications to maximize the chances of approval. This includes understanding specific regulatory requirements and preparing businesses for inspections or audits.

How does Bangladesh Consultant support foreign investors in setting up businesses in Bangladesh?

Bangladesh Consultant supports foreign investors in setting up businesses in Bangladesh through several key services:

1. Legal and Regulatory Guidance

Company Registration: Bangladesh Consultant assists in registering companies with the Registrar of Joint Stock Companies (RJSC) and Firms, ensuring compliance with Bangladesh’s Companies Act 1994.

Joint Venture Setup: They facilitate the formation of joint ventures by drafting agreements and preparing Memoranda and Articles of Association (MOA and AOA), which are crucial for defining the roles and responsibilities of partners.

2. Market Entry Strategies

Market Insights: Bangladesh Consultant provides valuable insights into Bangladesh’s market dynamics, helping foreign investors understand local consumer behavior, suppliers, and distribution channels.

Strategic Partnerships: They connect foreign investors with local partners, enhancing access to resources and networks essential for long-term success in the Bangladeshi market.

3. Financial Compliance and Planning

Tax and VAT Compliance: Bangladesh Consultant ensures that businesses comply with tax laws and VAT regulations, reducing the risk of penalties and ensuring smooth operations.

Financial Planning: They offer tailored financial planning services, including actuarial valuations and risk management strategies, to support sustainable business growth.

4. Operational Setup

Banking and Financial Services: Bangladesh Consultant helps in opening temporary bank accounts for capital deposits and obtaining necessary financial documents like encashment certificates

Licenses and Permits: They assist in obtaining required licenses and permits from relevant authorities, such as BIDA for branch or liaison offices

5. Ongoing Support

Risk Management: Bangladesh Consultant provides ongoing support in managing operational risks and adapting to changes in the regulatory environment.

Strategic Advice: They offer advice on market expansion and diversification, helping businesses navigate Bangladesh’s evolving economic landscape.

By offering these comprehensive services, Bangladesh Consultant helps foreign investors navigate the complexities of setting up and operating a business in Bangladesh.

What specific incentives does the Government of Bangladesh offer to foreign investors?

The Government of Bangladesh offers several incentives to attract foreign investors:

1. Tax Incentives

Tax Holidays: Up to 15 years for select industries like power generation and generally five to seven years for many business investments.

Double Taxation Avoidance: Bangladesh has bilateral agreements with 28 countries to avoid double taxation, ensuring that foreign investors do not face double taxation on their income.

2. Duty Exemptions

Import Duty Exemptions: No import duty for export-oriented industries and a reduced duty of 5% ad valorem for other industries.

Tariff Concessions: Concessions on import of capital machinery and raw materials for export-oriented industries.

3. Financial Incentives

Full Repatriation: Facilities for full repatriation of invested capital, profits, and dividends.

Accelerated Depreciation: Up to 100% depreciation allowance on plant and machinery for new industries.

4. Investment Flexibility

100% Foreign Equity: No restrictions on foreign equity participation; 100% foreign ownership is allowed.

No Regional Restrictions: No zonal restrictions on investment, allowing flexibility in choosing business locations,

5. Operational Incentives

Bonded Warehousing: Facilities for bonded warehousing to support export-oriented industries.

Cash Incentives: Cash incentives ranging from 5% to 20% on the FOB value of selected export products.

6. Regulatory Support

One-Stop Service: The Board of Investment (BIDA) provides a one-stop service for all approvals, simplifying the investment process.

Protection Against Expropriation: Legal protection against expropriation and nationalization under the Foreign Private Investment Act 1980.

These incentives are designed to create a favorable investment climate and encourage foreign investors to participate in Bangladesh’s growing economy.

How does Bangladesh Consultant help foreign investors navigate the tax and VAT compliance process in Bangladesh?

Bangladesh Consultant helps foreign investors navigate the tax and VAT compliance process in Bangladesh through several key services:

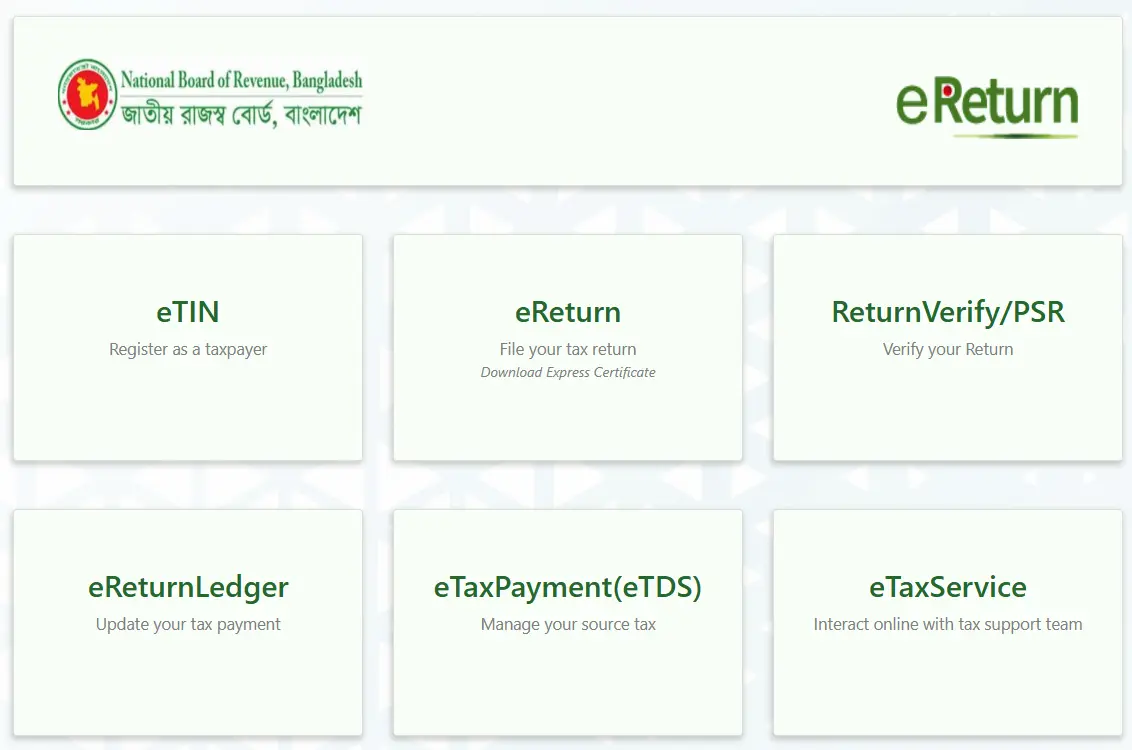

1. Tax Registration and Compliance

Taxpayer Identification Number (TIN): Bangladesh Consultant assists in obtaining a TIN from the National Board of Revenue (NBR), which is essential for filing tax returns and avoiding future compliance issues.

Tax Planning and Advisory: They provide expert advice on tax planning, ensuring that foreign investors are aware of and comply with all applicable tax laws, including corporate income tax rates and potential tax holidays.

2. VAT Registration and Compliance

VAT Registration Process: Bangladesh Consultant guides businesses through the VAT registration process with the NBR, ensuring that they meet the necessary thresholds and comply with VAT regulations.

VAT Compliance Services: They offer ongoing support in managing VAT returns, ensuring timely filing and compliance with VAT laws to avoid penalties

3. Compliance with Regulatory Bodies

Regulatory Support: Bangladesh Consultant helps foreign investors comply with all relevant regulatory bodies, including the Bangladesh Bank and the Board of Investment (BOI), ensuring that businesses operate within legal frameworks.

Documentation and Reporting: They assist in preparing and submitting necessary documents to regulatory authorities, ensuring that all legal and financial obligations are met.

4. Strategic Tax Planning

Tax Optimization Strategies: Bangladesh Consultant devises strategies to minimize tax liabilities while ensuring compliance with evolving tax laws, including international tax planning and double taxation avoidance agreements.

Risk Management: They help manage tax-related risks by identifying potential compliance issues and providing solutions to mitigate them.

By offering these services, Bangladesh Consultant simplifies the tax and VAT compliance process for foreign investors in Bangladesh, ensuring that businesses operate efficiently and legally within the country’s regulatory environment.

Case Studies

1: Tech Startup in Dhaka

Challenge: A tech startup in Dhaka faced challenges in navigating Bangladesh’s regulatory environment and securing funding.

Bangladesh Consultant‘ Role: Bangladesh Consultant provided comprehensive legal and financial guidance, helping the startup register with the relevant authorities and secure seed funding through their network of investors.

Outcome: The startup successfully launched its product, achieving significant market traction and expanding its operations across Bangladesh.

2: Foreign Investment in Manufacturing

Challenge: A foreign investor was interested in setting up a manufacturing facility in Bangladesh but needed assistance with compliance and operational setup.

Bangladesh Consultant‘ Role: Bangladesh Consultant facilitated the setup process by handling legal compliance, tax planning, and operational logistics, ensuring a smooth transition into the Bangladeshi market.

Outcome: The manufacturing facility became operational within a short timeframe, creating jobs and contributing to Bangladesh’s economic growth.

3: E-commerce Platform

Challenge: An entrepreneur wanted to launch an e-commerce platform in Bangladesh but lacked expertise in supply chain management and financial compliance.

Bangladesh Consultant‘ Role: Bangladesh Consultant offered strategic advice on supply chain optimization and ensured compliance with VAT and tax regulations, enabling the platform to scale efficiently.

Outcome: The e-commerce platform became one of the leading online retailers in Bangladesh, offering a wide range of products and services to consumers across the country.

FAQs

Our consulting service fees depends on the complexities, duration and workload of the services you require. However, we offer hourly services, flat fee packages, retainer arrangements and customized plans only to meet your needs. Rest assured, whichever plan you would opt, it would be highly competitive.

The most common financial challenges faced by the businesses in Bangladesh includes lack of funding particularly for SMEs probably because, the banks provide a lower credit limits or high interest rates. Moreover, cash-flow mismanagements is also another problem most of the Bangladeshi businesses suffer from especially the businesses with long payment cycles or based on seasonal business. The businesses also have issues with the taxation and regulatory compliance either due to lack of knowledge or may be the process is tedious and confusing which leads to a penalty.

We provide expert guidance to draft the Memorandum of Association (MOA) and Articles of Association (AOA), ensuring compliance with Bangladesh’s legal requirements and alignment with your business goals.

Yes, we take the fullest advantages of the modern technologies and software to ensure the highest quality of service to our clients. We utilize leading-edge software for financial services, data analysis, and of course Artificial intelligence for providing streamline financial service, optimized decisions and tailored solutions to our clients.

We offer local expertise, global standards, comprehensive services, and a proven track record, all tailored to your unique business needs.

Yes, we support startups with registration & compliance and help established businesses with tax optimization, compliance, and expansion strategies.

We handle TIN and VAT registration, prepare and file returns, optimize tax liabilities, and represent you during audits.

Yes, we provide services like maintaining statutory records, filing annual returns, organizing meetings, and ensuring corporate governance compliance.

Yes, we offer continuous support, including compliance monitoring, regulatory updates, and strategic advice for long-term success.

Yes, we help with cross-border tax compliance, double taxation agreements, and international business setup and expansion strategies.